MGIC Form 71-70321 2010-2025 free printable template

Show details

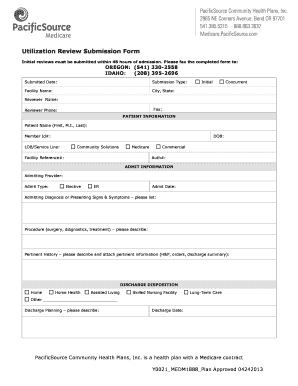

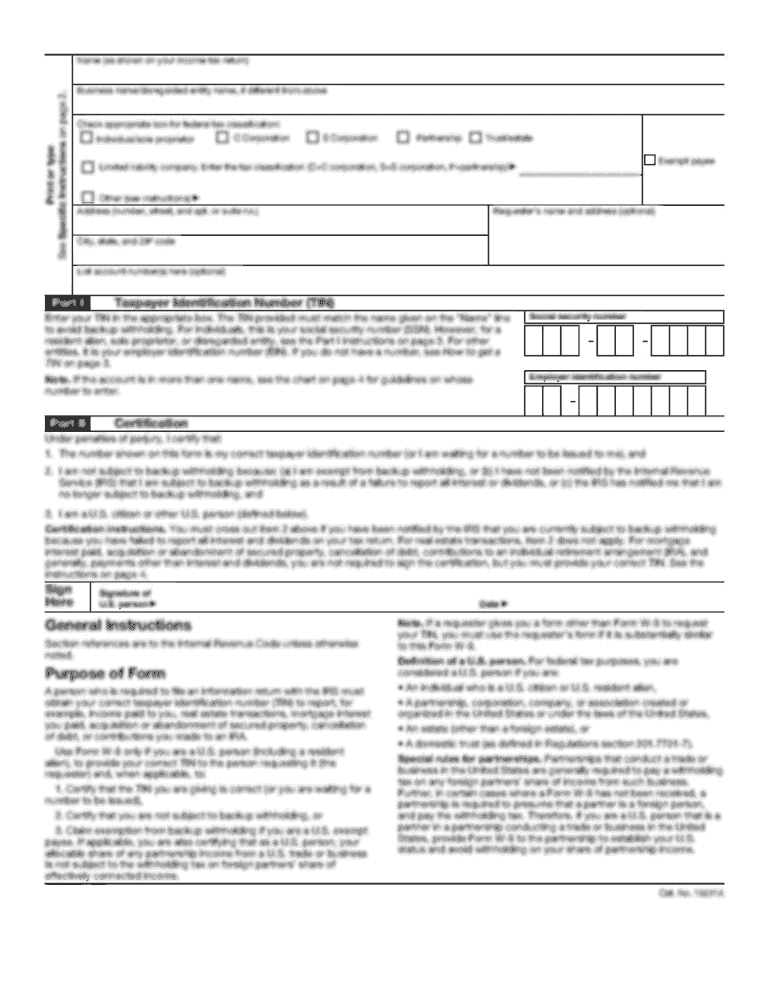

Mortgage Guaranty Insurance Corporation MAGIC Indemnity Corporation Mortgage Insurance Application/Transmittal MAGIC ID Number Broker's MAGIC ID Number Co-Borrower Name First-Time Homebuyer Y N Self-Employed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign mgic form

Edit your mgic address form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MGIC Form 71-70321 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MGIC Form 71-70321 online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MGIC Form 71-70321. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out MGIC Form 71-70321

How to fill out MGIC Form 71-70321

01

Obtain the MGIC Form 71-70321 from the official MGIC website or your lender.

02

Fill in your personal details in the designated fields, including your name and address.

03

Provide the property address for which the mortgage insurance is requested.

04

Indicate the loan details, including the loan amount and type.

05

Review the insurance coverage options and select the one that suits your needs.

06

Sign and date the form to verify that all information provided is accurate.

07

Submit the completed form to your lender or insurance provider as instructed.

Who needs MGIC Form 71-70321?

01

Homebuyers who are obtaining a mortgage and need mortgage insurance.

02

Lenders who require mortgage insurance for loan approval.

03

Real estate professionals assisting clients with the mortgage process.

Fill

form

: Try Risk Free

People Also Ask about

What is Sam on calculator?

Standard allowed minutes (SAM) = (Basic minute + Bundle allowances + machine and personal allowances). Add bundle allowances (10%) and machine and personal allowances (20%) to basic time. Now you got Standard Minute value (SMV) or SAM.

How is self-employment income calculated?

You calculate net earnings by subtracting ordinary and necessary trade or business expenses from the gross income you derived from your trade or business. You can be liable for paying self-employment tax even if you currently receive social security benefits.

What is the definition of self-employment income?

Self-employment income is income that arises from the performance of personal services, but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee.

What is the self employment income analysis?

The self-employed income analysis (form 1084A or 1084B) should be used to determine the borrower's share or a corporation's after-tax income and non-cash expenses after obligations that are payable in less than one year have been deducted from the corporate tax returns.

How do underwriters verify self-employment income?

The lender may verify a self-employed borrower's employment and income by obtaining from the borrower copies of their signed federal income tax returns (both individual returns and in some cases, business returns) that were filed with the IRS for the past two years (with all applicable schedules attached).

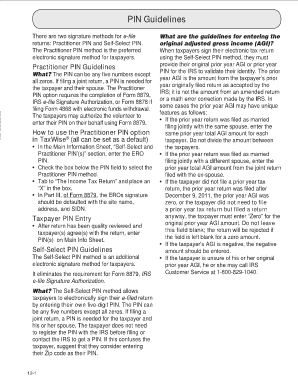

What is the SAM method of income calculation?

SAM method says “Start with $0 and ONLY add on the income (Schedules) of income you want”. Plain and simple compare to AGI. With the SAM method you would only add on the income that you had the correct documents to support and knew the income met the rest of the qualifications outlined for use in the guidelines.

How do you calculate K 1 income for a mortgage?

They calculate your income by adding it up and dividing by 24 (months). For example, say year one the business income is $80,000 and year two $83,000. The income used for qualifying purposes is $80,000 + $83,000 = $163,000 — then divided by 24. That shows a monthly income of $6,791 per month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MGIC Form 71-70321 in Gmail?

MGIC Form 71-70321 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for signing my MGIC Form 71-70321 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your MGIC Form 71-70321 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out MGIC Form 71-70321 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MGIC Form 71-70321. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is MGIC Form 71-70321?

MGIC Form 71-70321 is a specific form used for reporting mortgage insurance premiums and related information to the relevant authorities.

Who is required to file MGIC Form 71-70321?

Mortgage lenders and insurers who are involved in providing mortgage insurance are required to file MGIC Form 71-70321.

How to fill out MGIC Form 71-70321?

To fill out MGIC Form 71-70321, provide the necessary information including borrower details, loan information, and premium payments as instructed on the form.

What is the purpose of MGIC Form 71-70321?

The purpose of MGIC Form 71-70321 is to document and report mortgage insurance transactions, ensuring compliance with regulatory requirements.

What information must be reported on MGIC Form 71-70321?

Information that must be reported on MGIC Form 71-70321 includes borrower name, loan amount, insurance premium amounts, and other related mortgage details.

Fill out your MGIC Form 71-70321 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MGIC Form 71-70321 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.